An End of a Turbulent Year

Middle East Socioeconomic Overview

Report: December 2025

Winter floods wreak havoc on Gaza displacement camps as the Occupier blocks aid. Photo credit: Al Jazeera.

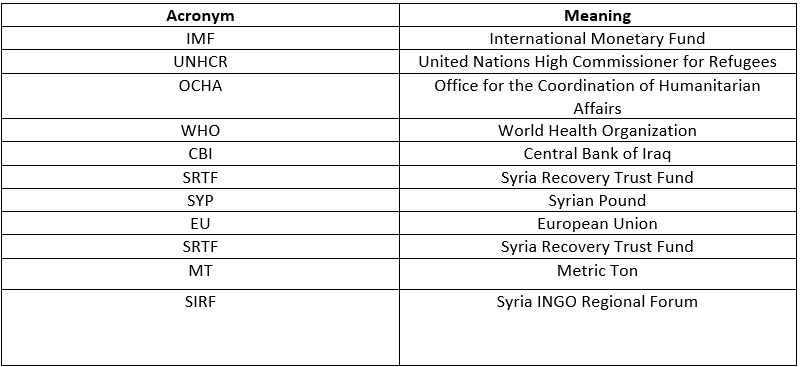

1. Table of Acronyms

2. Introduction

As a turbulent year comes to an end, 2026 might not be that different. There are concerns the region is entering another period of acute strategic tension as state and non-state actors are exchanging threats. While dialogue in some areas look promising, some actors have only shown a consistent propensity for war, even during times of intensive diplomatic activity. Therefore, there still persists an elevated risk of localized conflict or renewed multi-theater conflict over the coming months. Moreover, the situation in Gaza remains unresolved as the humanitarian situation remains to be daunting and negotiations are at constant risk of falling apart.

3. The Socio-Economic Situation

Egypt

The World Bank reveals a solution that could increase the size of Egypt's economy by 67%. Photo credit: alarabiya.net

According to forecasts released by the World Bank, the Egyptian economy could be on track for record growth rates over the next 25 years. However, Egypt is suffering from a job creation crisis despite currently low unemployment rates, as an average of 1.3 million young Egyptians enter the labor market annually, yet only about half a million jobs are created in the same year. The World Bank noted that the vast majority of women in Egypt are unemployed or not participating in the workforce. The Bank explained that this imbalance underscores the urgent need to accelerate job creation and the enormous potential of Egypt's youth to build a more sustainable and prosperous future for the country. It also predicted that achieving full employment for young people would increase GDP by 36%, and closing the gender employment gap could increase it by an estimated 68%. This increase could mean that the overall Egyptian economy could increase by about 67% if these goals are achieved. The bank stressed that achieving sustainable growth requires strong institutions, effective regulations, macroeconomic stability, and an inclusive environment that empowers women and youth. The Bank predicted that these measures would lead to the Egyptian economy growing by more than 6% annually between 2026 and 2050, generating up to 2.3 million job opportunities annually.

The World Bank also added that the private sector will be responsible for achieving the growth target and creating more and better jobs for young Egyptians, as the private sector already produces about 75% of Egypt’s GDP and employs more than 80% of the workforce, making it the natural engine for job growth. However, several structural obstacles hinder it from realizing its full potential. Access to finance remains limited, with private sector credit representing less than 30% of GDP, compared to 47% in lower-middle-income economies and 135% in middle-income countries. The World Bank believes that by easing restrictions, through clear regulations, improved access to land, labor and capital, and increased transparency, Egypt can enhance its investment climate and unleash the full potential of private sector-led job creation. Also, the bank claimed that some initiatives and programs adopted by the Egyptian government could help achieve the goal, such as the Digital Egypt program to expand online business registration, electronic signatures, and electronic payments. Meanwhile, the ongoing modernization of customs is gradually reducing the times for releasing goods - from 16 to 8 days so far. The bank believes that taking complementary measures to expand access to finance for small and medium enterprises, enhance the allocation of industrial land, and modernize technical and vocational training will also be essential to translating reforms into tangible job creation.

Jordan

The IMF expects the Jordanian economy to grow by 3% in the coming years., photo credit: erembusiness.com

According to the International Monetary Fund (IMF), the Jordanian economy grew by 2.7% during the first half of 2025, and expects growth to rise to 3% in the coming years. To nurture the growth of the Jordanian economiy, the fund, under the IMF’s Resilience and Sustainability Facility (RSF) program, enabled an immediate disbursement of 97.784 million Special Drawing Rights, equivalent to about $130 million, bringing the total disbursements under the program to about $733 million. The IMF expects inflation to stabilize at around 2%, with the current account deficit falling to less than 5% of GDP over the medium term, supported by the stability of the banking sector and the Kingdom maintaining comfortable levels of foreign reserves. The International Monetary Fund confirmed that the performance of public finances is in line with the program’s objectives, through improving the efficiency of revenue collection and controlling current expenditures, in addition to the Jordanian government’s commitment to reducing public debt to 80% of GDP by 2028. This is also done through gradual measures to control spending and reduce losses of public service companies, while maintaining social spending and development projects. Also, the IMF pointed out that Jordan’s public debt reached 82.8% of GDP at the end of last August, compared to 83.2% in the previous month, after recalculating GDP based on 2023 data as the base year. Concerning its opinion of how The IMF noted the government’s determination to accelerate the pace of structural reforms with the aim of achieving stronger growth and providing more job opportunities, by improving the investment environment, enhancing competition, increasing labor market flexibility, strengthening social safety nets, and accelerating the digitization of government services. Regarding the Resilience and Sustainability Facility program, the Fund explained that progress is continuing in addressing imbalances in the water and electricity sectors and strengthening health services, noting the completion of the reform measures planned for this review within the Structural Support Fund.

Iraq

Al-Alaq: Weak economic diversification makes Iraq an importing country and puts pressure on the dollar and the exchange rate. Photo credit: observeriraq.net

The Governor of the Central Bank of Iraq, Ali Al-Alaq, confirmed that the limited economic diversification and weak productive sectors have made Iraq a country that is primarily an importer, which puts continuous pressure on the dollar and the exchange rate. Of course, this is not new but another verbal reiteration which many analysts have been warning about over the past years. Al-Alaq claimed that the Iraqi economic landscape is facing accumulating pressures that require diversifying the economy and maximizing public revenues. He explained that public finances in Iraq depend on oil by more than 90%, a resource subject to fluctuations in global prices, which leads to fluctuations in revenues and weak financial stability, stressing the need to adopt structural solutions that reduce this dependence. He explained that the rise in purchasing power and the increase in daily demand for foreign currency directly impact monetary policy, despite the successes achieved by the Central Bank in managing liquidity, maintaining price stability, and stimulating the economy. Al-Alaq pointed out that the pressures of public spending, particularly salaries, subsidies and basic services, represent a major challenge. Also there is a difficulty of reducing these expenditures due to the social repercussions they may cause, at a time when the Central Bank is seeking to avoid inflation and maintain monetary stability. He stressed that Iraq has succeeded in recent years in financing part of the budget deficit through the development of non-oil revenues, in coordination with the Prime Minister, in an effort to reduce the dominance of oil in the general budget. The Central Bank Governor revealed plans to proceed with the governance of the banking sector through a comprehensive reform plan implemented in cooperation with an international company, which includes reassessing bank licenses according to new standards to enhance the resilience of the banking system. He also called for the establishment of a regional platform for dialogue between creditors and debtors to address the debt issue, warning of losses that could range between 20 and 25% as a result of ill-considered financing terms or delays, and stressing that regulation and dialogue contribute to reducing these losses and enhancing economic stability.

Lebanon

Governor of Lebanon's central bank: Draft law on deposit recovery needs further clarification and strengthening of the state's obligations. Photo Credit: Reuters

In a bid to move Lebanon’s economy forward, the Lebanese government approved a draft law on financial regulation and loss distribution, more than six years after an unprecedented economic crisis deprived Lebanese citizens of their life savings. The draft law was passed despite objections from political and banking forces to its content. With the approval of 13 ministers and 9 opposing, the government approved the draft law stipulating the distribution of financial losses between the state, the central bank, commercial banks and depositors. The project, known as the Fiscal Gap Law, represents a long-awaited and essential step to restructure Lebanon’s debt since the economic crisis that has plagued it since the fall of 2019, and is considered a cornerstone of financial and economic reforms. Depositors whose deposits are less than $100,000, representing 85% of total accounts, will be able to recover their entire deposits over a period of 4 years. As for large depositors, they will be able to obtain $100,000, with the remainder of their deposits to be compensated through tradable bonds, which will be backed by the assets of the central bank, whose portfolio includes approximately $50 billion. The governor of Lebanon’s central bank, Karim Saeed, expressed reservations about the draft law claiming that the proposed timetable for repaying the cash portion of the deposits is a bit too ambitious. He noted that the draft Financial Stability and Deposit Repayment Law can, when necessary, be amended without violating the rights of depositors, in order to ensure the regularity, continuity and full completion of payments over time. He also recommended that the Cabinet should carefully review the law, aimed at introducing the necessary improvements and safeguards to ensure fairness, credibility and practicality, before referring it to the House of Representatives. The governor of the Central Bank of Lebanon said that the draft law needs further clarification and reinforcement with the state's commitments.

Palestine

United Nations: The Palestinian economy is experiencing an unprecedented collapse. Photo credit: alkhaleej.ae

The United Nations Conference on Trade and Development (UNCTAD) released a report claiming that the war and restrictions on the Gaza Strip have caused an unprecedented collapse in the Palestinian economy, confirming that the Gaza economy contracted by 87% during the period 2023-2024. UNCTAD added in a new report that rebuilding the Gaza Strip will cost more than $70 billion and could take several decades. It noted that the aggression has significantly undermined every pillar of survival, from food to shelter and health care, as Gaza has been pushed into a man-made abyss. It also stated that the ongoing and systematic destruction casts doubt on Gaza's ability to rebuild itself as a livable space and society, calling for immediate and significant international intervention. UNCTAD called for a comprehensive recovery plan that combines coordinated international assistance, resumption of financial transfers, and measures to ease restrictions on trade, movement, and investment, and the launch of a universal emergency basic income, giving every individual in Gaza a monthly, renewable, and unconditional cash transfer. Since October 7, 2023, the occupying state, has committed genocide in the Gaza Strip, including killing, starvation, destruction, displacement and arrest, ignoring international calls and orders from the International Court of Justice to stop it. The genocide left more than 239,000 Palestinians dead or wounded, most of them children and women, and more than 11,000 missing, in addition to hundreds of thousands of displaced people and a famine that claimed the lives of many, most of them children. Of course there is the vivid widespread destruction and the erasure of large common areas of the Gaza Strip from the map. The war of extermination also led to the destruction and disruption of 90% of the civilian infrastructure in the sector, with losses estimated at about $70 billion.

Syria

Syrian Economy Minister: We are working on launching the first investment cooperation program with Saudi Arabia. Photo credit: almodon.com

After years of severe sanctions slapped on Syria in an attempt to put pressure on the previous regime, the United States finally decided to cancel the Caesar Act in mid-December. This marks the beginning of a new phase in the Syrian economy and regional politics as the House of Representatives voted in favor of lifting the sanctions. Meanwhile, investors and economic actors are awaiting the repercussions of this decision on local markets and the oil and energy sector, which has been suffering for years. Nevertheless, Lifting the Caesar Act represents a qualitative shift in the Syrian investment climate, as foreign companies are no longer required to comply with strict legal restrictions. Also, the oil and energy sector is getting ready to reopen oil fields and repair the damaged infrastructure. As for the Syrian Central Bank, it sees this step as an opportunity to reintegrate with the global financial system and restore cash liquidity, but it insists that this progress is conditional on banking and legislative reforms to ensure that investments are attracted safely. Either way, the banking sector will directly benefit from the lifting of restrictions, which will reconnect Syrian banks to the international financial system and allow the flow of remittances and investments, thereby boosting confidence and increasing the ability to finance projects. All of this will inevitably lead to an improvement in income and purchasing power, along with the availability of new job opportunities and improved basic services. Despite all this positivity, economists still insist that Syria remains in a bit fragile state, as it still needs to enact reforms to regulate the investment and trade sector and restructure the industrial and commercial sectors, and strengthen the role of the private sector.

Syria’s leadership did not waste any time with the recent developments by moving forward in taking advantage of this significant shift. For instance, Minister of Economy and Industry, Mohammed Al-Shaar visited Saudi Arabia to boost the portfolio of his country. There, he claimed that Syria is entering a new phase, which is about economic and industrial reconstruction, opening the doors to investment, empowering the private sector, and expanding regional partnerships. He insisted that Syria will return to take its rightful place within the Arab world after the lifting of the sanctions. He also attended the "Made in Saudi Arabia" exhibition in Riyadh, were he announced joint work with Saudi Arabia to develop the first Saudi-Syrian investment cooperation program, which will allow for the implementation of joint projects with a qualitative economic impact. He stressed that investing in Syria goes beyond the local market to include a market that extends from the Gulf to the Mediterranean while taking advantage of Syria’s geographical location as a logistics hub for exporting joint products to Europe and North Africa at a competitive cost. Al-Shaar also explained that Syria’s participation in the “Made in Saudi Arabia” exhibition is not symbolic, but rather represents the beginning of broad industrial, investment and trade partnerships, including the energy, manufacturing, agriculture and food, pharmaceuticals and biotechnology, textile and engineering industries, logistics and environmental trade sectors.

Cyprus

UAE, Cyprus strengthen trade, investment relations; agree to establish business council. photo credit: knews.kathimerini.com.cy

During the month of December, Cyprus and the UAE formed a joint business council aimed at strengthening private-sector cooperation and expanding trade and investment links. This was an act in accordance to the bilateral non-oil trade relationship which has been growing over the years. According to official figures, there has been a notable rise in bilateral trade, with non-oil foreign exchange between the two nations reaching $176 million from January to September, a 39.4 percent increase compared to the same period in 2024. As such, the council was formed in Nicosia during a meeting between UAE Minister of foreign Trade and business leaders from both countries. The minister also met with Cyprus President Nikos Christodoulides and addressed a UAE-Cyprus Business Roundtable, highlighting opportunities for collaboration across sectors including oil and gas, renewable energy, logistics, as well as real estate, technology and artificial intelligence. The signing comes during a time both countries are witnessing robust economic growth and doing such a move would go hand in hand with their strategic goals. Also Cyprus will benefit specifically from this deal as it is a service-based economy and has seen a 3.2 percent increase in gross domestic product in the first half of 2025, largely due to consumer spending and investment activity. Moreover, it is aiming to further strengthen its role as an innovation hub, with tools such as the Cyprus Securities and Exchange Commission’s sandbox, the Central Bank of Cyprus’ Innovation Hub and the upcoming AI Sandbox, which facilitate the testing, scaling and commercialization of new solutions with access to the single market of 450 million EU citizens.

4. The Humanitarian Situation

Egypt

According to the New Humanitarian magazine, deportations of Sudanese refugees are only increasing in Egypt. Moreover, it insists that there is a growing criticism of the UNHCR and its failure to do anything about it. [1]

Jordan

The UNHCR states that there are currently 427,351 registered refugees in Jordan up until the beginning of December.

The proportion of Syrian displaced people registered within the UNHCR, are distributed as follows:

-135,954 in Amman Governorate (31.8%)

-107,339 in Mafraq Governorate (25.1%)

-76,539 in Irbid Governorate (17.9%)

-62,182 in Zarqa Governorate (14.6%)

-11,565 in Balqa Governorate (2.7%)

-8,933 in Madaba Governorate (2.1%)

-5,174 in Jarash Governorate (1.2%)

-5,509 in Karak Governorate (1.3%)

-6,459 in Maan Governorate (1.5%)

-3,282 in Ajlun Governorate (0.8%)

-3,032 in Aqaba Governorate (0.7%)

-938 in Tafilah Governorate (0.2%)

-445 in other (0.1%)

More than 83,400 refugees and vulnerable Jordanians have received assistance through an initiative to support education and provide legal protection services in Jordan, the Norwegian Refugee Council (NRC) reported as the project closed in December.[2]

Iraq

The UNHCR states that there are currently 347,209 registered refugees in Iraq. Of those, 91,210 live in camps.

The proportion of refugee people registered within the UNHCR up until the beginning of November, are distributed as follows:

-150,042 in Erbil (43.2%)

-91,872 in Dahuk (26.5%)

-39,751 in Sulaymaniyah (11.4%)

-2,748 in Ninewa (0.8%)

-43,103 in Baghdad (12.4%)

-18,749 in other areas (5.4%)[3]

As of the beginning of December, UNHCR, the UN refugee agency in Iraq, has been forced to halt monthly cash assistance to the most socio-economically vulnerable refugee families due to a critical lack of funding.[4]

Lebanon

{Distribution data has not been updated for the month of December}

Since the beginning of October the number of registered Syrian refugees in Lebanon is 636,051.

Refugees in Lebanon are distributed as follows:

-229,271 in Bekaa (36%)

-198,022 in North Lebanon (31.1%)

-141,787 in Beirut (22.3%)

-66,971 in South Lebanon (10.5%)[5]

According to the Famine Early Warning Systems Network (FEWS NET), an organization established by USAID, high annual food inflation continues to constrain household food access. Although annual headline inflation declined in early 2025, food inflation remains elevated at 23.9 percent year-on-year as of September 2025, well above headline inflation at 15.1 percent.[6]

Syria

The United Nations World Food Programme (WFP), in partnership with the Ministry of Economy and Industry, is expanding and extending its Subsidized Bread Programme through March 2026, because of a contribution from the United States government. Beginning in January 2026, distributions will support over 300 bakeries nationwide, some of which were previously rehabilitated by WFP, providing daily bread assistance to more than 4 million people.[7]

Norway committed NOK 55 million (approx. USD 5.4 million) over the next three years to the Aid Fund for Syria, to strengthen the work of local organizations on the ground.[8]

According to Action against Hunger, fighting continues in the north and south, and the humanitarian crisis is far from over. Today, nine out of ten Syrians live below the poverty line. Nearly 17 million people require urgent assistance to survive, and more than nine million face acute food insecurity.[9]

CARE International warned during December, that without sustained and quality funding, vital humanitarian programs will be at risk at a time when needs are rising across Syria.[10]

Polish Humanitarian Action appealed in December for support for Syria and emphasizes now is the time for a true test of solidarity.[11]

Qatar Red Crescent Society (QRCS) completed a furnishing and infrastructure development project for two residential villages in Idlib Governorate, northern Syria, earlier constructed by QRCS to provide decent and stable housing for internally displaced people, instead of shelter tents

Cyprus

According to a report released by the UNHCR, the organization has received for the year of 2025 67% of its required funding.[12]

[1] OCHA, December 4, 2025, https://www.thenewhumanitarian.org/investigations/2025/12/04/exclusive-egypt-ramps-sudan-refugee-deportations-unhcr

[2] OCHA, https://reliefweb.int/report/jordan/jordan-nrc-supports-more-83400-refugees-and-jordanians-education-protection

[3] https://data2.unhcr.org/en/situations/syria/location/5

[4] OCHA, Dec 4, 2025, https://reliefweb.int/report/iraq/thousands-refugee-families-cut-cash-assistance-funding-dries-enarku

[5] UNHCR, Oct 28, 2024, https://data2.unhcr.org/en/situations/syria/location/71

[6] OCHA, Dec 2, 2025, https://reliefweb.int/report/lebanon/lebanon-key-message-update-water-scarcity-conflict-and-drought-drive-food-insecurity-lebanon-november-2025

[7] OCHA, Dec 16, 2025, https://reliefweb.int/report/syrian-arab-republic/wfp-expands-and-extends-its-subsidized-bread-programme-across-syria

[8] OCHA, Dec 9, 2025, https://reliefweb.int/report/syrian-arab-republic/norway-contributes-usd-5-million-support-locally-led-humanitarian-efforts-syria-8-december-2025

[9] OCHA, Dec 8, 2025, https://reliefweb.int/report/syrian-arab-republic/one-year-after-political-upheaval-syria-millions-people-still-need

[10] OCHA, Dec 8, 2025,https://reliefweb.int/report/syrian-arab-republic/one-year-humanitarian-needs-syria-remain-critical-care-calls-sustained-support

[11] OCHA, https://reliefweb.int/report/syrian-arab-republic/one-year-after-now-syrians-need-international-support-more-ever-8-december-2025

[12] OCHA, Dec 8, 2025, https://reliefweb.int/report/cyprus/unhcr-cyprus-2025-funding-update-30-november-2025