A World on the Edge

Middle East Socioeconomic Overview

Report: January 2026

Turmoil in neighboring Iran and the standoff between the US and the country’s leadership is making the Middle East and the world nervous. Photo credit: https://www.theguardian.com/

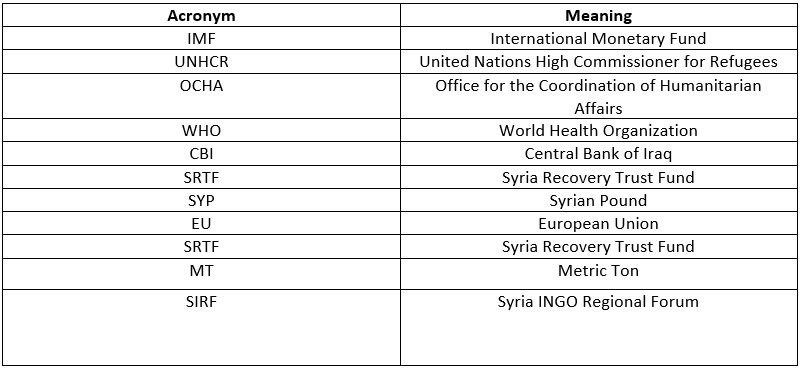

1. Table of Acronyms

2. Introduction

The year started with news of regime changes and military escalations worldwide. There is no doubt 2026 will be an interesting year full of events that will change the course of history. Leaders need to mindful of any impulsive decision that can trigger a sequence of uncontrollable events which can have regional as well as international consequences. During an age of economic turmoil and stagnation, any wrong move can add fuel to the fire which can consume more than it should.

3. The Socio-Economic Situation

Egypt

Egyptian tourism is soaring as 19 million tourists visit the country. Photo credit: skynewsarabia.com

The Egyptian economy is expected to see improved performance during 2026, amid indications of a very limited decline in the value of the Egyptian pound, with the government focusing on its external competitiveness and encouraging non-oil exports. Exchange rates will remain stable, with increasing dollar liquidity and an improving economy, amid net foreign asset growth in Egypt of $10 billion, the highest in a decade. The Egyptian pound's exchange rate has improved significantly over the past five months, rising to its highest level in more than a year, supported by strong foreign currency inflows from tourism. Moreover, International and local financial institutions have recently raised their estimates for the performance of a number of economic indicators in Egypt during the coming year, most notably the exchange rate of the dollar against the pound, inflation rates, and the growth rate. These adjustments were driven by a marked and simultaneous improvement in a range of economic factors, most notably strong growth in foreign inflows and a decrease in geopolitical tensions in the region. In addition to the increasing demand for direct and indirect foreign investments in the Egyptian market, this has strengthened confidence in the ability of the Egyptian economy to achieve greater stability and attract more investments. Nevertheless, Investment banks had varying expectations regarding the strength of the Egyptian pound, with new trading range for the currency between 45 and 49 pounds to the dollar.

Concerning the non-oil sector as mentioned above, the tourism sector is worth discussing. Egypt's tourism sector continues to strengthen its role as a cornerstone of the national economy and a major source of foreign currency, recording unprecedented figures last year. Egypt welcomed approximately 19 million tourists, making it the second most popular tourist destination in Africa after Morocco, while sector revenues reached $24 billion, representing a 57% increase compared to 2014. This exceptional performance reflects the global demand for Egyptian destinations, as flights to Egypt welcomed passengers from approximately 193 cities around the world. This momentum is attributed to several factors, most notably the opening of the Grand Egyptian Museum, the maintenance of security stability despite regional challenges, and the competitive prices offered by Egypt compared to other tourist destinations. In light of these achievements, the government has developed a strategic plan to boost the sector’s growth, which includes attracting $35 billion in investments to add 340,000 new hotel rooms and achieve the goal of receiving 30 million tourists by 2031.

Jordan

According to the World Bank, Jordan's expected economic growth rate is 2.8%. Photo credit: https://alghad.com/

The World Bank, in its latest report, predicted that economic growth in Jordan would rise to 2.8% during the current and next two years, in light of the remarkable improvement witnessed in the local market. This comes at a time when the report predicted that the growth rate in the region, the Middle East and North Africa, would rise to 3.6% in 2026 and then to 3.9% in 2027. The bank estimated in its January 2026 World Economic Outlook report that the Jordanian economy achieved a growth rate of 2.7% last year, as a result of the positive performance shown by the various indicators of the Jordanian economy during the past year. The World Bank’s confirmation that Jordan has maintained its economic stability despite a turbulent regional environment is an important indication of the strength of the country’s monetary and financial frameworks, and its ability to manage external shocks efficiently. Jordan’s Economic Modernization Vision and its implementation mechanism have contributed to enhancing the positive outlook by the World Bank and global institutions and ratings, given its commitment to a clear timeframe and its inclusion of many development programs and projects in the public and private sectors, which are characterized by their long-term nature and focus on improving the business environment, digital transformation, and expanding access to finance. According to a World Bank document on the progress made in the Jordan Growth and Competitiveness Enhancement Program, the Jordanian economic performance remains largely robust; inflation has remained under control, public debt is on a corrective path, and the financial sector continues to maintain its stability. The document lauded the fact that the government is moving forward with the implementation of its long-term reform program within the framework of the economic modernization vision and the public sector modernization roadmap, with a special focus on private sector development, digital transformation, energy efficiency, and enhancing the economic participation of women and youth.

Iraq

Record high levels of private investment in Iraq in the energy, housing, health, education, transportation, and services sectors. Photo credit: www.alarabiya.net

The National Investment Commission in Iraq made a significant announced claiming that, over the past year, there has been an increase in the volume of private investments, proven by the fact that 850 investment applications for various projects have been filed. The spokesperson for the commission, Hanan Jassim, claimed that the National Investment Commission concluded 2025 by achieving a number of qualitative and strategic accomplishments that reflected its commitment to developing the investment environment in Iraq and stimulating local and foreign investments, in line with the Sustainable Development Goals, the government program, and the national development plan. According to the Iraqi News Agency (INA), she added that the volume of investments achieved during the past three years amounted to more than $102 billion, in a clear indication of rising investor confidence and paving the way for achieving higher figures during 2026. She said that these efforts contributed to the issuance and amendment of about 40 investment licenses for strategic projects, including power generation plants, smart electricity billing projects in Baghdad and several governorates, residential complexes, commercial centers, airports, and service projects, in addition to participation in approximately 30 joint technical and legal committees to address obstacles and expedite the completion of transactions. As for the issue of enhancing governance and transparency, she stated that the Authority has activated the electronic “single window system” and adopted the electronic portal for investment licenses, in addition to launching the electronic inquiry program in coordination with the General Secretariat of the Council of Ministers. This allowed investors and citizens to track their applications through the government services portal, contributing to reducing time and effort and improving the level of service.

Lebanon

IMF calls for revisions to rescue plan as financial crisis deepens. Photo credit: alarabiya.net

According to Lebanese Prime Minister Nawaf Salam, the International Monetary Fund (IMF) has requested amendments to a draft financial rescue law which aims to get Lebanon out of its worst financial crisis ever and give depositors access to their savings that have been frozen for six years. The Fiscal Gap Act, which is part of a series of reform measures required by the International Monetary Fund to provide financing, sets out how to distribute the financial losses resulting from Lebanon’s 2019 financial collapse between the state, the central bank, commercial banks and depositors. The PM also claimed that the IMF wants clearer rules on the hierarchy of claims, a key element of the bill. He had claimed so in an interview during the annual meeting of the World Economic Forum in the mountain resort of Davos, Switzerland: "We want to deal with the International Monetary Fund. We want to improve. This is a bill." Salam stressed that Lebanon is still seeking the long-delayed IMF program, but warned that time is running out because the country is already on a financial grey list and faces the risk of being blacklisted if reforms falter further. The bill which was submitted in December is currently under parliamentary review. It aims to provide depositors with a guaranteed way to recover their funds, resume bank lending, and end the financial crisis that has frozen nearly a million accounts and shattered confidence in the banking system. As mentioned in a previous overview, the bill would lead to the repayment of up to $100,000 to depositors over four years, starting with small accounts, while launching forensic audits to determine losses and liability. From his end, Finance Minister Yassin Jaber said that rescuing the crumbling banking system has become a necessity to prevent the country from sliding further into a paralyzed economy that relies solely on cash. He stressed that the goal is to give depositors clarity after years of uncertainty, and to restore Lebanon’s financial standing. Jaber indicated that the bill is part of a broader reform process and marks the first time the government has dealt with the simultaneous collapse of the banking sector, the central bank, and the state treasury. He also warned that continued paralysis will keep Lebanon stuck in a "deep and dark tunnel" with no prospect of recovery.

Palestine

Palestinian Statistics Director to Al-Ittihad: Unprecedented demographic and economic collapse in Gaza, Photo credit: aletihad.ae

The Director General of Economic Statistics at the Palestinian Central Bureau of Statistics, Muhammad Qalalwa, revealed that the population of Gaza has decreased by 10.6%, which is equivalent to about 250,000 people, as a result of war casualties, displacement and a decline in birth rates. Qalalwa explained that the demographic and economic indicators in Palestine witnessed radical and unprecedented changes during the war on the Gaza Strip, pointing out that Palestinian society is still a young society, as 64% of the population is under the age of 30, noting that the victims of the war are children, and are estimated to number around 18,000. Of course, this will leave long-lasting effects on the age structure of society. He pointed out that the Palestinian economy declined by about 24% during the two years of war, and that 2025 witnessed only a marginal improvement that did not compensate for the cumulative losses. The economic decline contributed to the rise in unemployment rates, which reached 77% in Gaza. The poverty rate in the sector has increased to 85%, with widespread acute malnutrition and indicators of famine, confirming that traditional concepts of poverty no longer reflect reality. The Palestinian official also stated that the Palestinian economy is small, and any organized financial intervention could have a rapid impact, but real recovery remains contingent on a political decision and a halt to occupation policies that have targeted all aspects of the economy simultaneously. He pointed to the rise in prices in Palestine during the past year by about 11%, with increases reaching 22% in the Gaza Strip, and a decrease in consumer spending by about 20%, reflecting a sharp deterioration in standards of living. Statistics showed that the economic system in the Gaza Strip collapsed by up to 85%, while the economy in the West Bank declined by about 13% compared to before the war, and the size of the Palestinian economy decreased from about $15 billion to about $11 billion.

Syria

The Syrian president meets with the president of the European Council and the president of the European Commission. Photo credit: North Press.

The year started with an announcement by the EU of a new 620 million euros support package for Syria. This is a significant indication of the beginning of a different phase in the international approach to Syria— a phase in which efforts to recover and gradually re-engage after many years of war and isolation are progressing. This support comes in conjunction with successive political and economic developments, as the President of the European Commission, Ursula von der Leyen, revealed that the European Union will provide Syria with this amount, during the current year and the next year, within the framework of bilateral support, humanitarian aid, and for post-war recovery. The European move is not limited to the financial aspect, as the European Union announced its intention to start talks to revive a cooperation agreement with Syria, in addition to launching a new political partnership that includes high-level talks expected to be held during the first half of this year. These steps come in the wake of the decision to lift European economic sanctions on Syria last year, following the overthrow of the previous regime. The country has recently witnessed practical steps to strengthen the path of economic openness, represented by the reintegration of Syria into the international "SWIFT" payment system, in addition to the announcement of comprehensive banking reforms, as well as the signing by US President Donald Trump, at the end of 2025, a move seen as a way to revitalize the economy and open the door to foreign investment and aid.

Another positive sign that Syria’s economy is stepping into a new phase is the fact that the issuance of the new Syrian currency has begun. Syrian banks have started receiving the new currency, in which one lira is equal to one hundred old Syrian liras. There is, however, a six-month grace period to complete the replacement of the old lira with the new lira. The change in the form and value of the Syrian pound came as part of a broad economic reform following major political changes in Syria. This was an effort to restore confidence in the Syrian financial and economic situation after years of inflation and currency devaluation. Of course, the true value of the Syrian pound against foreign currencies remains tied to the economy and its prosperity, to factors related to economic and investment relations between Syria and other countries, to the demand for dollars, and to the political and security situation in Syria. This measure, along with the new image of the currency, does not mean that the economic crisis is over. Despite the change in figures, the Syrian economy still faces challenges such as inflation, loss of reserves, strong demand for the dollar, and large import needs. According to Syrian economists, removing the two zeros is useful for regulating accounts, but it is not a magic solution to reduce inflation or immediately increase purchasing power. This is also what was indicated by the Central Bank of Syria. Nevertheless, the move indicates preparedness of the economy to move in the right direction.

Cyprus

Cyprus attracts record €16.5b demand in 10-year bond issue. Photo Credit: cbn.com.cy

The month of January started with a positive development indicating that Cyprus’s economy is only improving. A new €1 billion 10-year bond by the Republic of Cyprus was completed successfully, after attracting total bids reaching €16.5 billion, the highest amount ever recorded for a Cypriot sovereign debt issuance. President of the Republic Nikos Christodoulides described the successful issuance of the Republic of Cyprus’ 10-year bond as a vote of confidence by international markets in the Cypriot economy and the country. According to him, the fact that there was a 16-fold oversubscription of the Republic of Cyprus’s bond issuance, with bids of €16.5 billion for a €1 billion issue indicates confidence by international markets in the Cypriot economy. He also reflected on the growth rate of 3.1% of 2026 which is the highest in Europe. From his end, Minister of Finance Makis Keravnos expressed his full satisfaction with the strong success of the issuance, noting that investor interest was exceptionally high and far exceeded the amount sought by the Republic. He pointed out the fiscal discipline and financial stability which are both precedents of this success. He also inferred that the government will continue to implement its economic policy aimed at sustained, stable and sustainable growth. This will continue to create attractive conditions for foreign and domestic investment, while focusing on the continued reduction of public debt as a percentage of GDP. All of this will eventually pave the way for greater fiscal space to deepen the government’s social policy for the benefit of lower- and middle-income segments of society.

4. The Humanitarian Situation

Egypt

According to UNHCR, Egypt registered in January 14,375 people coming from Sudan.[1]

Jordan

The UNHCR states that there are currently 420,835 registered refugees in Jordan up until the beginning of January.

The proportion of Syrian displaced people registered within the UNHCR, are distributed as follows:

-134,245 in Amman Governorate (31.9%)

-105,384 in Mafraq Governorate (25.0%)

-75,241 in Irbid Governorate (17.9%)

-61,510 in Zarqa Governorate (14.6%)

-11,448 in Balqa Governorate (2.7%)

-8,764 in Madaba Governorate (2.1%)

-5,072 in Jarash Governorate (1.2%)

-5,438 in Karak Governorate (1.3%)

-6,353 in Maan Governorate (1.5%)

-3,228 in Ajlun Governorate (0.8%)

-2,999 in Aqaba Governorate (0.7%)

-926 in Tafilah Governorate (0.2%)

-227 in other (0.1%)

The United Nations High Commissioner for Refugees (UNHCR) and the World Food Programme (WFP) welcome EUR 22,850,000 (approximately $26,820,000) of new funding from the European Union to support refugee programmes in Jordan. The contribution will address the immediate needs of the most vulnerable refugees and their host communities, while also supporting efforts to strengthen the self-reliance of those with the potential to engage in work, wherever opportunities may arise.[2]

Iraq

The UNHCR states that there are currently 348,603 registered refugees in Iraq. Of those, 91,739 live in camps.

The proportion of refugee people registered within the UNHCR up until the beginning of January, are distributed as follows:

-150,042 in Erbil (43.1%)

-91,978 in Dahuk (26.4%)

-39,816 in Sulaymaniyah (11.4%)

-2,761 in Ninewa (0.8%)

-43,655 in Baghdad (12.5%)

-20,351 in other areas (5.8%)[3]

1,031,475 IDPs remain displaced in Iraq. This includes 101,8862 people living in the 20 IDP camps, located in the Kurdistan Region of Iraq. Of this population, 19,329 IDP families (92,616 individuals) continue to reside in 15 camps across Dohuk Governorate and Zakho Administration, 1,063 families (5,367 individuals) remain in two camps in Erbil Governorate, and 777 families (3,903 individuals) remain in the three East Mosul Camps.[4]

Lebanon

Since the beginning of January the number of registered Syrian refugees in Lebanon is 532,357.

Refugees in Lebanon are distributed as follows:

-189,605 in Bekaa (35.6%)

-165,737 in North Lebanon (31.1%)

-119,773 in Beirut (22.5%)

-57,242 in South Lebanon (10.8%)[5]

According to the World Food Programme, around 874,000 people – approximately 17 percent of the population analysed – are facing Crisis (IPC Phase 3) or Emergency (IPC Phase 4) levels of acute food insecurity between November 2025 and March 2026.[6]

Syria

The International Rescue Committee (IRC) and the Norwegian Refugee Council (NRC) working in north-east Syria warn that movement restrictions and insecurity have led to the suspension of critical services for more than 24,000 people, including nearly 15,000 children in Al Hol camp in Al-Hasakeh governorate.[7]

Kurdistan Save the Children (KSC) raised an urgent alarm over the escalating violence and systematic attacks unfolding across Syria.[8]

Kurdistan Save the Children (KSC) raised its concern on the ongoing attacks targeting Aleppo and the devastating humanitarian toll on civilians. The densely populated residential neighborhoods of Sheikh Maqsoud and Ashrafieh, home to hundreds of thousands, have suffered repeated bombardment, siege and collective punishment in violation of international law and human dignity.[9]

Cyprus

The Director General of the International Organization for Migration (IOM), Amy Pope, has concluded a visit to Cyprus. She focused on the pressing need to address conditions along key migration routes. She highlighted its work to reduce irregularity and the drivers of dangerous journeys, undermine smuggling networks, meet humanitarian needs, and save lives. She also highlighted the need for robust migration data systems and evidence-based analysis to guide policy decisions.[10]

[1] OCHA, UNHCR, Jan 22, 2026, https://reliefweb.int/report/egypt/egypt-new-arrivals-sudan-22-january-2026

[2] UNSDG, December 31, 2025, ttps://unsdg.un.org/latest/stories/rising-above-difficulty-supporting-economic-participation-refugees-jordan

[3] https://data2.unhcr.org/en/situations/syria/location/5

[4] OCHA, Jan 6, 2026, https://reliefweb.int/report/iraq/update-internal-displacement-iraq-december-2025

[5] UNHCR, Oct 28, 2024, https://data2.unhcr.org/en/situations/syria/location/71

[6] OCHA, Jan 19, 2026,https://reliefweb.int/report/lebanon/food-insecurity-lebanon-remains-fragile-despite-signs-easing-country-enters-new-year-new-analysis-shows

[7] OCHA, Jan 27, 2026, https://reliefweb.int/report/syrian-arab-republic/syria-insecurity-around-al-hol-camp-forces-suspension-critical-aid-services-aid-agencies-warn-nrc

[8] OCHA, Jan 21, 2026, https://reliefweb.int/report/syrian-arab-republic/ksc-raises-urgent-alarm-over-escalating-hostilities-and-grave-violations-childrens-rights-across-syria

[9] OCHA, Jan 9, 2026, https://reliefweb.int/report/syrian-arab-republic/ksc-condemns-attacks-and-siege-aleppos-sheikh-maqsoud-and-ashrafieh

[10] OCHA, Jan 23, 2026, https://reliefweb.int/report/cyprus/iom-chief-cyprus-eu-presidency-puts-migration-action